Benefites of SBI Credit Card Total Benefits...

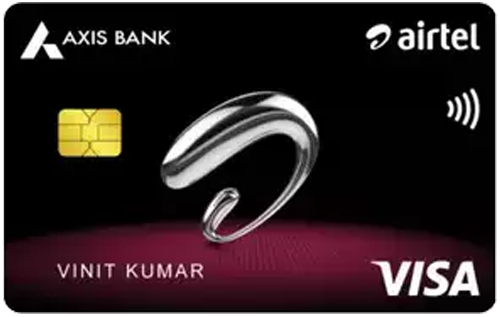

The Airtel Axis Bank Credit Card is a recently launched co-branded card offered by Axis Bank in partnership with the famous telecom services provider company, Bharti Airtel. Targeted at individuals who use most Airtel services, it comes with an affordable annual fee of Rs. 500 only and welcomes its customers with an exclusive Amazon gift voucher. It is a cashback credit card and earns you up to 25% cashback on Airtel Mobile, DTH, broadband bill payments via the Airtel Thanks app, 10% cashback on water, gas, and other utility bill spends via the Airtel Thanks app and 10% cashback on partner merchants. The redemption also becomes hassle-free as the earned cashback is automatically credited to your account. Not only this, but you also get complimentary airport lounge access at selected airport lounges in India. Other benefits of the Airtel Axis Bank Credit Card include up to 20% discount on dining across several participating restaurants, a 1% fuel surcharge waiver of up to Rs. 500 per month and spend-based waiver of the annual membership fee. To know all about its benefits, advantages, and fees & charges in detail, keep reading our Airtel Axis Bank credit card review:

New Features

The annual fee is waived off on spending Rs. 2 lakhs or more in the previous year.

3.6% per month

Nil

Nil

1% fuel surcharge waiver on all transactions between Rs. 400 and Rs. 4,000.

3.5% of the total transaction amount.

2.5% of the withdrawn amount or Rs. 500 (whichever is higher)

Up to 20% off on dining across 4000+ participating restaurants.

Complimentary domestic lounge access.

NA

25% cashback on Airtel Mobile, Broadband, WiFi, and DTH recharges, 10% cashback on utility bill payments via the Airtel Thanks app, 10% cashback on Swiggy, Zomato and BigBasket, and 1% cashback on other spends.

NA

NA

Direct cashback to the credit card statement.

4 complimentary domestic lounge access every year.

You will not be liable for any fraudulent transactions made on a lost/stolen card if the loss is reported to the bank in a timely manner.

You would get 25% exclusive cashback on Airtel Mobile, WiFi, Broadband and DTH services. Additionally, you will receive a 1% cashback on all other purchases. Airtel Axis Bank Credit Card has an easy application process, and the card is usually delivered between 7 to 10 days.

With the Airtel Axis Bank Credit Card, you have access to domestic lounges, but not international lounges. This card is handy for those who make payments for bills and utilities via Airtel. Users who use platforms like Amazon Pay or Google Pay cannot benefit from it greatly.