Benefites of SBI Credit Card Total Benefits...

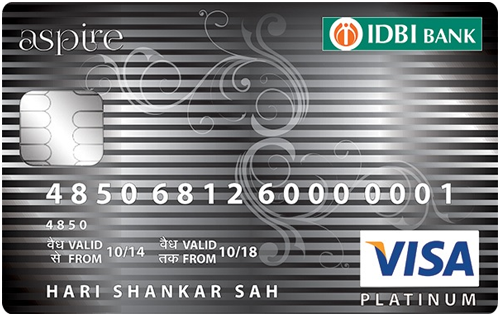

IDBI Aspire Platinum Bank credit card is a card launched by IDBI Bank that provides you with exclusive lifestyle benefits and privileges on your spendings. You get 2 Delight points on every Rs 150 spent on shopping, dining, traveling. In addition to this, you get 500 delight points on spending Rs 1500 or above in the first 30 days of issuance of the card. Furthermore, you also get 300 delight points on the spending of Rs 1500 or above in 31 to 90 days of the issuance of the card. You also get additional benefits associated with credit cards such as a fuel surcharge waiver, zero protection liability, and EMI facility. Read below to know more in detail about this credit card.

New Features

NA

2.9% per month (34.8% per annum)

Nil

Nil

1% surcharge waiver on fuel transactions between Rs 400 to Rs 4000

3.5% on the conversion amount

2.5% on the withdrawal amount subject to minimum of Rs 500

NA

NA

NA

2 Delight points for every Rs 150 spent on shopping, dining, traveling

NA

NA

The delight points can be redeemed for a wide array of gifts vouchers providing you with lifestyle benefits. The points accumulated can be redeemed for cashback

NA

You get a zero liability protection cover in case of loss of the card or any fraudulent transactions reported within the stipulated time period.

No data available

No data available