Benefites of SBI Credit Card Total Benefits...

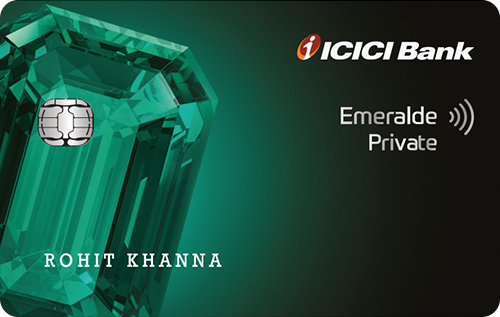

The ICICI Bank Emeralde Private Metal credit card is a new offering by ICICI Bank in the super-premium category and comes at a joining fee of Rs. 12,499 plus taxes. The card comes in a metal body and is packed with exclusive lifestyle and travel features for the cardholder. As a welcome benefit, you get a complimentary Taj Epicure membership for one year and an EazyDiner Prime membership, along with a bonus of 12,500 reward points. Even the reward rate on the credit card is quite decent, offering 6 Reward Points per Rs. 200 spent with the card across various spend categories. It does not end here, as you get complimentary EaseMyTrip air travel vouchers, complimentary international and domestic lounge access, movie benefits, and more. Also, those who make regular foreign spends can benefit from the low 2% forex markup fee on the credit card. Another key feature is the cancellation cover offered on flight/ticket bookings made with the card, up to Rs. 12000 twice per year. To know more about the card, including its features and offerings in detail, keep reading further.

New Features

Renewal fee waiver on spending Rs. 10 Lakhs or above in the card anniversary year

3.4% per month or 40.8% per annum

Nil

N/A

1% fuel surcharge waiver on transaction up to Rs. 4000 maximum

2% of the total transaction amount

Nil

Complimentary 12-month EazyDiner membership, Buy 1 ticket and get up to Rs. 750 discount on the second ticket on BookMyShow

Complimentary Taj Epicure membership, complimentary EaseMyTrip air travel vouchers

Get unlimited international lounge access with the Priority Pass

6 ICICI Reward Points per Rs. 200 spent on retail, grocery, education, insurance, and tax payment

Unlimited complimentary golf rounds and lessons at top courses around the world

No cancellation charges on flight/hotel ticket bookings and refund up to Rs. 12000, twice per year.

The ICICI Bank reward points earned for your spends can be redeemed against a host of products, travel, movie vouchers, appliances, mobiles, lifestyle products, and more.

Get unlimited domestic lounge access at select airports across the country

Get card liability cover of up to Rs. 50,000 in case of lost or stolen card

No data available

No data available