Benefites of SBI Credit Card Total Benefits...

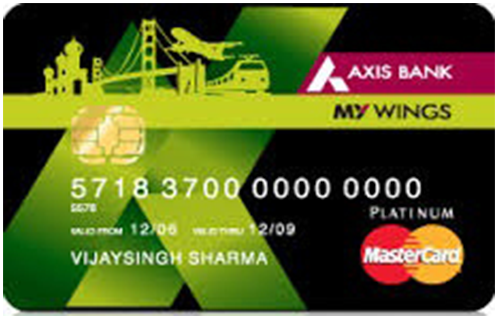

My Wings credit card by Axis Bank is an entry-level travel credit card that offers exciting cashback and reward points benefits on rail, road, and air travel spends. You get complimentary airport lounge access and discount and cashback benefits on rail/air tickets. As far as road travel is concerned, the card rewards you with a discount of Rs. 100 on bus tickets and a flat Rs. 400 off on car rentals. On top of these travel-related benefits, you also enjoy dining privileges with a minimum 15% discount on dining bills at partner restaurants under the Axis Bank’s Dining Delights program. Read on to learn more about this offering by Axis bank.

New Features

N/A

3.40% per month (49.96% per annum)

Nil

Nil

1% fuel surcharge waived off at all filling stations across India for transactions between Rs. 400 and Rs. 4,000 (max waiver capped at Rs. 400 per month)

3.50% of the transaction amount

2.50% or a minimum of Rs. 500

Minimum 15% off on dining at partner restaurants

Complimentary domestic lounge access, cashback/discount on flight/rail/bus tickets and car rentals

N/A

4 EDGE Points for every Rs. 200 spent with the card

N/A

N/A

EDGE Points earned are redeemable for shopping/travel vouchers or products (from the given catalog) on the EDGE Rewards portal.

1 complimentary domestic lounge access per quarter

Cardholder not liable for any fraudulent transaction made with the card post reporting the loss of card to the bank.

No data available

No data available