Benefites of SBI Credit Card Total Benefits...

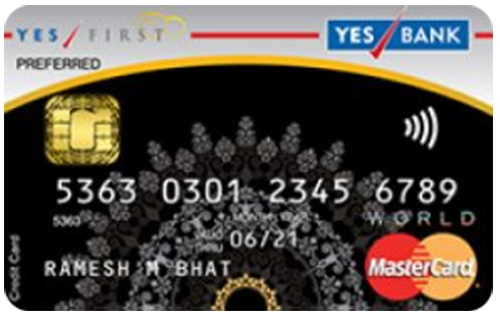

YES First Preferred credit card is a premium card having premier reward point offers and several other exciting benefits. You can save up to thousands of reward points whenever you make a purchase or pay the annual fee. Not only this, but the card also offers complimentary benefits in travel including domestic as well as international travel lounge access. Get 4 reward points every time you spend Rs. 200 on tax payments, utilities, groceries, etc, and 8 reward points on any other retail purchases. Although the YES First Preferred credit card is a good fit for people who love to save money by earning more and more reward points, it can also be a great choice for people who love traveling. It is because you get 2 domestic lounge access every quarter and 4 exclusive complimentary international lounge access every year. One of its greatest key features is that you get 10,000 reward points on your first transaction if it is done within the first 90 days once you receive the card.

New Features

The renewal fee can be waived off on a spend of more than 4 lakhs in the last year.

3.8% per month

Nil (up to 3 cards)

A reward redemption fee of Rs. 100 on every redemption request.

1% fuel surcharge waiver applicable at fuel stations all over India on a minimum of Rs. 400 transaction and a maximum of Rs. 5000 transaction.

1.75% on all foreign currency spends

2.5% of the transaction amount.

25% discount on movie booking through BookMyShow.

4 complimentary international lounge access per year and 2 domestic lounge access per calendar quarter.

You get 4 complimentary international lounge access every year through the Priority Pass.

4 reward points per Rs. 200 spent on Select categories utilities, groceries, tax payments, insurance sales, etc. 8 reward points per Rs. 200 you spent on every other retail purchase 16 reward points per Rs. 200 spent on travel and dining spends

4 complimentary green fee rounds annually.

Life insurance of up to Rs. 1 crore in the case of death due to flight accidents and medical insurance of Rs. 25 lakhs for emergency hospitalization.

1 Reward Point = Re. 0.25 for redemption against hotel/flight bookings, and 1 Reward Point = Re. 0.10 for redemption against gift vouchers, product catalogue, etc.

2 domestic lounge visits per quarter via the MasterCard lounge program.

Zero Liability protection is provided in case the lost or stolen card is reported within 3 days after losing it.

No data available

No data available