Benefites of SBI Credit Card Total Benefits...

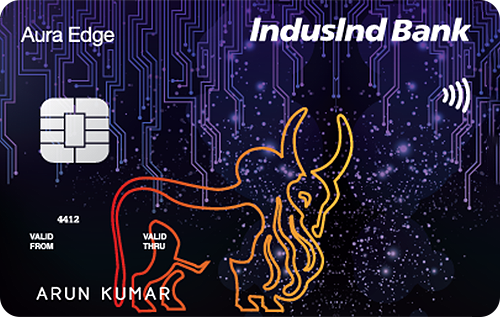

The IndusInd Bank Platinum Aura Credit Card is a card with exceptional features that provides its customers with exclusive reward offers and other benefits on the basis of their choice. With this card, you can choose any of the reward plans as per your spends. The card rewards you in the form of Saving Points, and you can earn up to 4 saving points on every Rs. 100 you spend using this card. The card comes with a very nominal joining fee of Rs. 500, and after paying it, you get the welcome benefit of discount gift vouchers from Pantaloons, Bata, Raymond, Hush Puppies, and more. To make your travel experiences better and secure, the card provides various travel insurance benefits. The cardholders can also avail of the 24*7 concierge and auto-assistance services. There are several other benefits of the IndusInd Bank Platinum Aura Edge Credit Card. To know all of them in detail, keep reading:

New Features

NA

3.95% per month

Nil

Rs. 100

1% fuel surcharge waiver for all transactions between Rs. 400 and Rs. 4,000

3.5% of the foreign currency amount transacted

2.5% or Rs. 300 (whichever is higher)

N/A

N/A

N/A

0.5 Saving points per Rs. 100 spent on all categories. Up to 4 saving points per Rs. 100 spent on selected categories.

N/A

You get insurance coverage against an air accident, lost/delayed baggage, lost passport/ticket and unauthorized transactions made on a lost/stolen card.

1 RP = Re. 0.5 for redemption against cash credit and 1 RP = 1 Intermile / 0.5 CV Point for redemption against Intermiles or CV Points.

N/A

Zero liability protection against a lost/stolen card on reporting the loss to the bank within 48 hours.

This card has a one-time joining fee of Rs. 500, and there are no card renewal charges. The reward rate offered by this card is good in all major categories.

No international or domestic lounge access is provided with this card. There aren’t any movie or dining privileges provided with this card.